Global Health

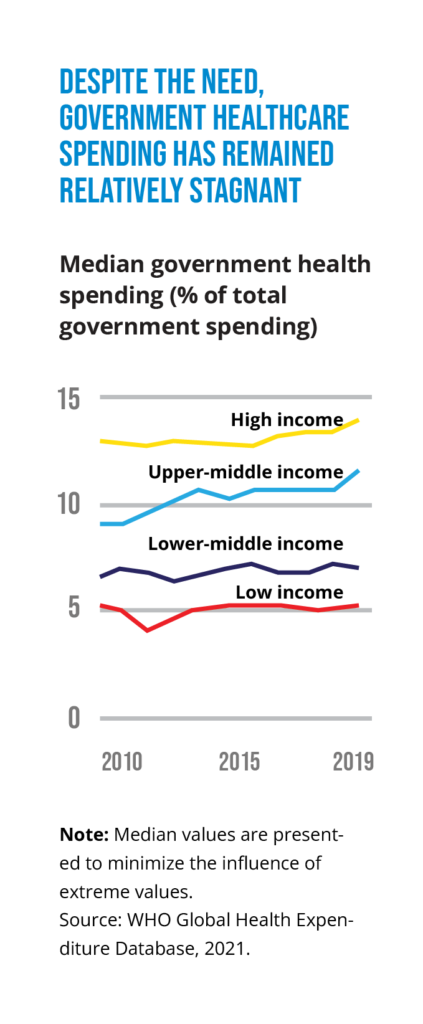

It’s fair to say that the current state of health financing is mixed. On the one hand, outside of pandemic-related funding, public financing hasn’t kept pace with the increasing need for healthcare, due to rapidly aging populations and the rising incidence of noncommunicable diseases. In addition, there is more emphasis on responding to health problems than on preventing them, and political will to take important funding measures is in short supply.

On the other hand, country-level appreciation of the need to boost investment in healthcare is rising; there is positive movement in private-sector solutions; and the pandemic has helped foster recognition that a well-financed healthcare system can strengthen economic health.

The following are four key trends that we see in health financing during 2022.

PRIVATE-SECTOR ENGAGEMENT WILL RISE

Private-sector efforts are growing, and increasingly, they are taking the form of innovative partnerships. Prominent among these efforts are blended capital and health impact bonds.

Blended capital is funding contributed by multiple sources that may include governments, international organizations, and private-sector entities. A blended instrument is structured to address two primary objectives: achieving a specific health outcome and generating an acceptable return for investors.

One of the best-known examples is Maternal Outcomes Matter (known as MOMs), which aims to improve maternal health in sub-Saharan Africa and South Asia, where women are dying at high rates from complications of pregnancy and childbirth. Launched in 2019 with a commitment of $50 million in debt and grant financing, MOMs is a collaboration of the U.S. International Development Finance Corporation, MSD for Mothers, Credit Suisse, and the U.S. Agency for International Development.

Health impact bonds are a form of blended capital that combines elements of impact investing, private-sector partnerships, and results-based contracting. The Utkrisht impact bond, for instance, has raised around $50 million to support private healthcare facilities in Rajasthan, India, to help reduce maternal and newborn mortality. The Brookings Institution reports that there are 32 active health impact bonds worldwide.

NEW SOURCES OF FINANCING WILL ADDRESS GLOBAL PANDEMICS

The global fight to control the coronavirus and prepare for future pandemics got a potentially big boost from the G20 nations in 2021. In October, G20 health and finance ministers announced the formation of a Joint Finance-Health Task Force to forge greater cooperation and support sustainable financing by member states.

We’re optimistic the task force can be a catalyst for meaningful action by the G20 and the world. More specifically, we are looking for five developments in 2022:

• Creation of a new financing facility with

the flexibility to complement

multilateral development banks

• Establishment of a financial

intermediary fund, along with a

common understanding about how its

funds will be managed

• Commitment by member states to

provide a level of funding

commensurate with the scale of need

• Recognition that governments must

mobilize increased domestic resources

on a sustained basis

• Efforts to leverage the capabilities of the

private and philanthropic sectors

MORE COUNTRIES WILL ADOPT UNIVERSAL HEALTH COVERAGE

Universal health coverage (UHC) isn’t universal: Some nations offer healthcare to their citizens at little or no cost, but others don’t. While there is growing interest in attaining UHC, doing so will require sufficient, sustained, equitable, and creative funding together with an openness to developing new partnerships.

The United Nations has adopted 2030 as its target date for global UHC and will host a meeting in 2023 to review the progress that has been made so far. But achieving the 2030 goal isn’t assured, and diverse financing approaches will be needed. We see the biggest obstacles as insufficient funding and the political calculus in many governments that getting to UHC simply isn’t feasible.

Our hope is that in 2022, the combination of momentum at the UN and the massive damage wrought by COVID-19 can push more countries toward their UHC goals.

DATA WILL HELP FIGHT RARE—AND NOT-SO-RARE—DISEASES

Historically, the diseases whose treatments have gotten the most financial attention are the Big Three: HIV/AIDS, malaria, and tuberculosis. Funding is much lower for rare diseases (extremely debilitating illnesses that affect a relatively small number of people). While treatments for rare diseases are expensive to develop and bring to market, their effectiveness could have lasting gains for society in terms of mortality and economic productivity.

Data is playing an increasingly important role in fighting rare diseases. New tools to analyze disparate and complex data sets are accelerating efforts to diagnose and treat rare diseases. Big data analytics is also being used for more common diseases. Pharmaceutical giant Roche, for example, is using its data on the costs and usage of innovative cancer treatments to help improve insurance coverage for cancer therapies and diagnostics in China. We expect this data sweet spot—at the intersection of healthcare and insurance—to attract more interest going forward.